The Federal Reserve & Banking System

Truth Carriers Academy | True History Series

Student Name:

Date Started:

The Federal Reserve: Structure and Money Creation Process

HOW TO USE THIS WORKBOOK

The Truth Carriers Learning Method (6 Rs)

RECEIVE (read), REFLECT (answer questions), RECALL (close book, write from memory), RECITE (teach someone), REVIEW (spaced repetition), RESPOND (apply practically).

"The rich ruleth over the poor, and the borrower is servant to the lender." — Proverbs 22:7

ABOUT THIS WORKBOOK

Introduction: This workbook exposes the hidden mechanisms of the modern banking system. You will learn how money is created, who controls it, and why the national debt is mathematically impossible to pay off. This is not conspiracy theory; it is documented history and mathematics.

What You Will Learn:

- The Federal Reserve is NOT a government agency—it's a private banking cartel

- How fractional reserve banking creates money from nothing

- Why the national debt is mathematically impossible to pay off

- The dollar has lost 96-97% of its purchasing power since 1913

- Who really owns the Federal Reserve (Jekyll Island meeting)

- The 2008 bailout: taxpayer theft to save "too big to fail" banks

- Biblical principles on usury, debt, and honest weights

- Practical steps to protect your family from the system

Sacred Names Used: Yahuah (not LORD), Elohim (God)

Target Audience: Adults (18+)

Study Time: 6-8 hours

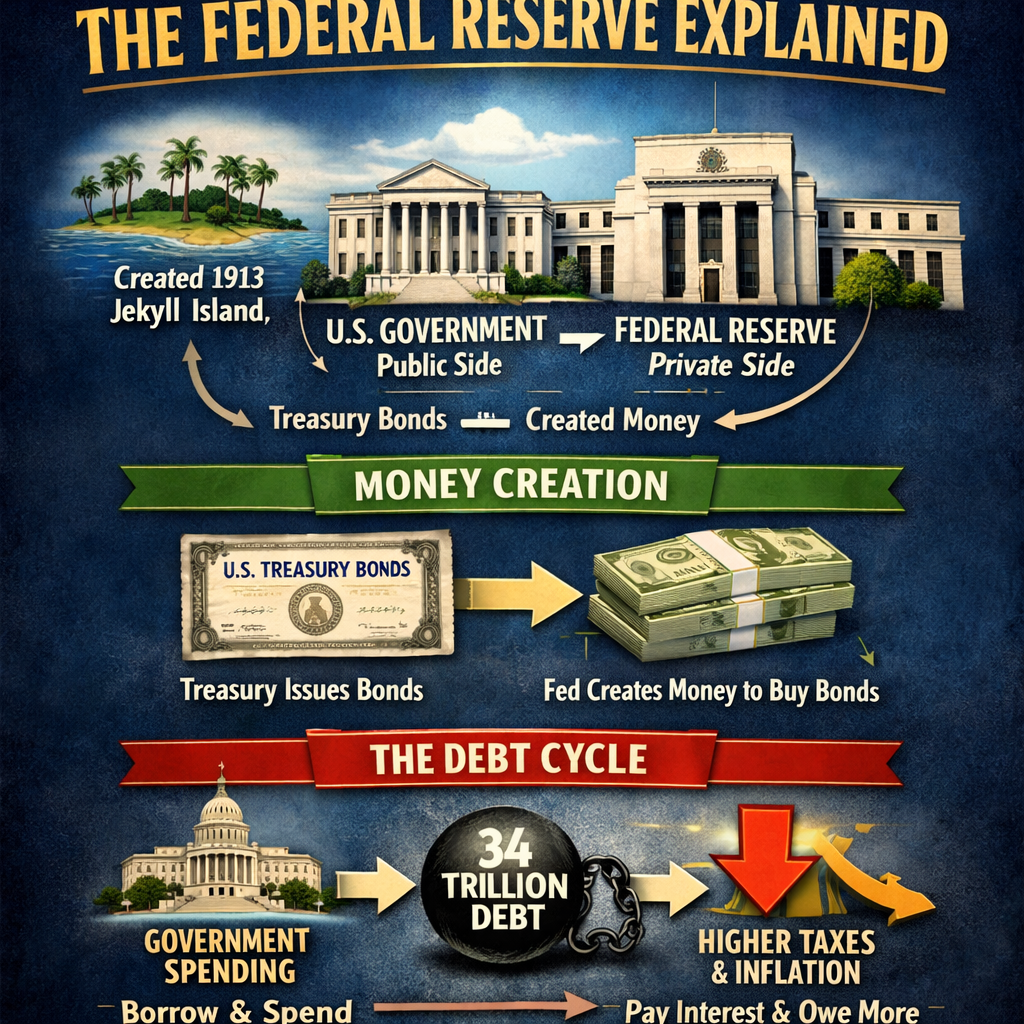

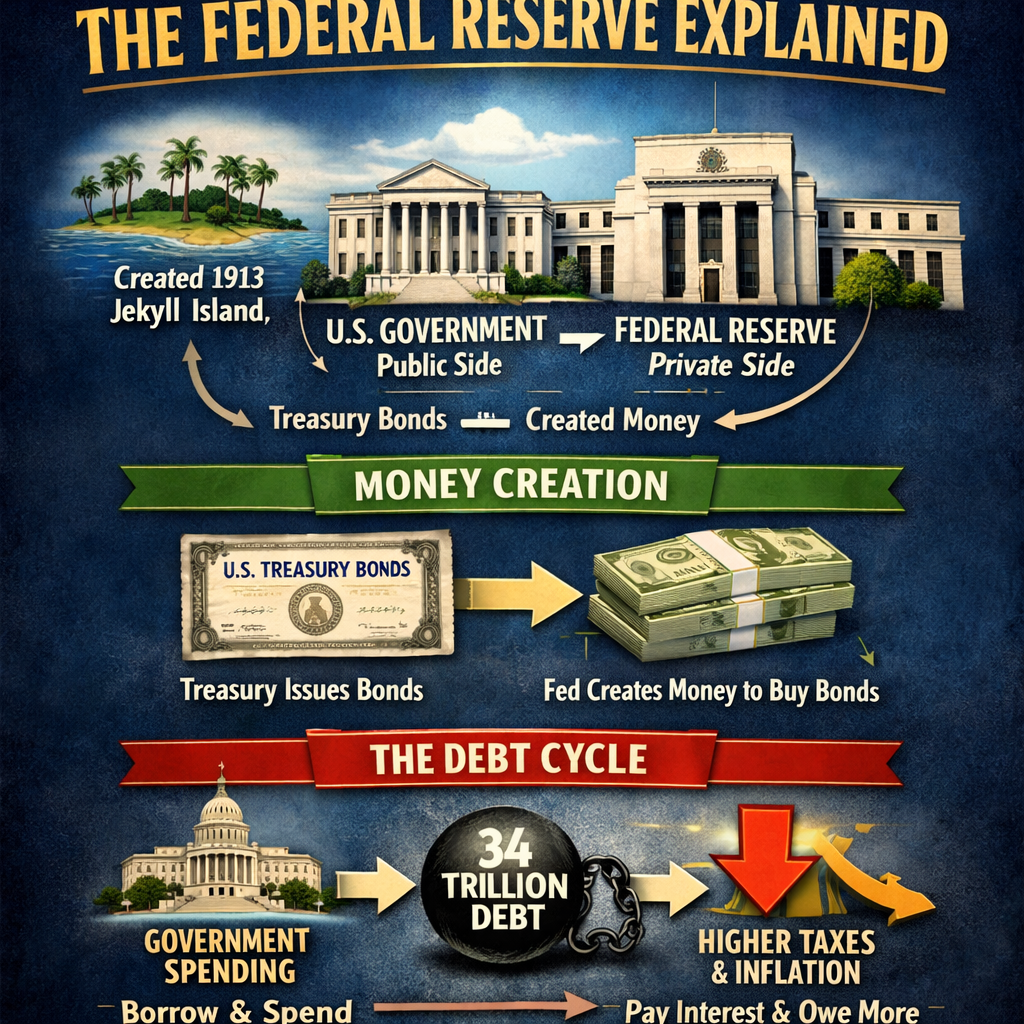

The Federal Reserve System: Structure and Money Creation

Lesson 1: What is the Federal Reserve?

Most Americans believe the Federal Reserve is a government agency. It is not. It is a private banking cartel that was given control over the nation's money supply in 1913.

- Mayer Amschel Rothschild [Founder of the Rothschild Banking Dynasty]

Key Facts

- Creation Date: December 23, 1913 (The Federal Reserve Act was passed while most of Congress was away for Christmas break).

- Structure: 12 regional banks owned by private member banks.

- Oversight: The Fed has never been fully audited. "Audit the Fed" bills are repeatedly blocked in Congress.

Review Questions

1. The Federal Reserve was created on , 1913.

2. True or False: The Federal Reserve is a branch of the U.S. Government.

3. Why is it significant that the Federal Reserve Act was passed just before Christmas?

Multiple Choice

1. The Federal Reserve is:

○ A) A branch of the U.S. Treasury

○ B) A private banking cartel

○ C) A nonprofit government agency

○ D) Part of the Department of Commerce

2. How many regional Federal Reserve banks exist?

○ A) 1

○ B) 5

○ C) 12

○ D) 50

3. Has the Federal Reserve ever been fully audited?

○ A) Yes, annually

○ B) Yes, once in 1933

○ C) No, never

○ D) Yes, but results are classified

True or False (Correct any false statements)

1. The word "Federal" in Federal Reserve means it is a government agency.

○ True ○ False — Correction:

2. The Federal Reserve was created in 1913.

○ True ○ False — Correction:

3. Congress has repeatedly passed "Audit the Fed" legislation.

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. Write: What year was the Fed created? What day specifically? What is the Fed's structure? Who has audited it?

Items I need to review:

TEACH-BACK CHALLENGE

Explain to someone that the Federal Reserve is NOT a government agency.

Person I taught: Date:

Question they asked:

How I answered:

SCRIPTURE MEMORY: Proverbs 22:7

"The rich ruleth over the poor, and the borrower is servant to the lender."

Write from memory:

APPLICATION STEP

Before the next lesson, complete ONE:

What I did:

What happened:

Lesson 2: How Money is Created (Fractional Reserve Banking)

Modern money is not backed by gold or silver. It is "fiat" currency, backed only by debt. The process of creating money is called Fractional Reserve Banking.

- Sir Josiah Stamp [Director of the Bank of England, 1920s]

The Mechanism

When you deposit $1,000 into a bank:

- The bank keeps 10% ($100) as "reserves."

- The bank lends out 90% ($900) to someone else.

- That $900 is deposited into another bank.

- That bank keeps 10% ($90) and lends out $810.

- This process repeats until the original $1,000 becomes approximately $10,000 in the money supply.

Result: 90% of the money in circulation is created as DEBT. It does not exist until someone borrows it.

Exercise

1. Explain "Fractional Reserve Banking" in your own words:

2. If a bank holds a 10% reserve requirement, how much money can they create from a $5,000 deposit?

Answer: $

Multiple Choice

1. What percentage of money in circulation is created as DEBT?

○ A) 10%

○ B) 50%

○ C) 90%

○ D) 100%

2. Under 10% reserve requirements, a $1,000 deposit can create how much money?

○ A) $1,000

○ B) $5,000

○ C) $10,000

○ D) $100,000

3. Modern "fiat" currency is backed by:

○ A) Gold

○ B) Silver

○ C) Debt/Nothing

○ D) Oil reserves

True or False

1. Banks lend out money that already exists in their vaults.

○ True ○ False — Correction:

2. Money does not exist until someone borrows it into existence.

○ True ○ False — Correction:

3. Banks keep 90% of deposits as reserves.

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. Explain the fractional reserve process: What happens when you deposit $1,000?

Items I need to review:

TEACH-BACK CHALLENGE

Explain to someone how banks create money from nothing.

Person: Date:

Question:

Answer:

SCRIPTURE MEMORY: Proverbs 11:1

"A false balance is abomination to Yahuah: but a just weight is his delight."

Write:

APPLICATION STEP

What I did:

Result:

Lesson 3: The National Debt Scam

The U.S. National Debt is currently over $38 Trillion (2025 estimate). But who do we owe this money to?

The Debt Trap

When the government needs money, it issues Treasury Bonds (debt). The Federal Reserve prints money (from nothing) to buy these bonds. The government then owes the Fed the money plus interest.

The Problem: The money to pay the interest was never created. Only the principal was created. Therefore, the total debt is always greater than the total money supply. It is mathematically impossible to pay off the debt without creating more debt.

National Debt Growth

| Year | Debt Amount | Debt Per Citizen |

|---|---|---|

| 1913 | $2.9 billion | $29 |

| 1980 | $907 billion | $4,000 |

| 2000 | $5.6 trillion | $20,000 |

| 2020 | $27 trillion | $82,000 |

| 2025 | $38 trillion | $113,000 |

Analysis

1. How much has the debt per citizen increased since 1913?

2. In 2024, interest payments on the debt exceeded $950 billion. Where does the government get the money to pay this interest?

Multiple Choice

1. The current U.S. national debt (2025) is approximately:

○ A) $3 trillion

○ B) $10 trillion

○ C) $38 trillion

○ D) $100 trillion

2. Debt per citizen in 2025 is approximately:

○ A) $1,000

○ B) $10,000

○ C) $50,000

○ D) $113,000

3. Why is the national debt mathematically impossible to pay off?

○ A) Congress refuses to pay

○ B) The interest was never created

○ C) Foreign countries own it all

○ D) Banks forgive it annually

True or False

1. The total debt is always greater than the total money supply.

○ True ○ False — Correction:

2. The money to pay interest on the debt is created alongside the principal.

○ True ○ False — Correction:

3. In 1913, debt per citizen was $29.

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. Write: Current debt amount, debt per citizen, and why the debt can never be paid off.

TEACH-BACK CHALLENGE

Explain the "debt trap" to someone - why the debt can never be repaid.

Person: Date:

Question:

Answer:

SCRIPTURE MEMORY: Romans 13:8

"Owe no man any thing, but to love one another..."

Write:

APPLICATION STEP

What I did:

Result:

Lesson 4: Currency Devaluation (Theft by Inflation)

Inflation is not a natural phenomenon; it is a hidden tax. By printing more money, the value of existing money decreases. This steals purchasing power from your savings.

Dollar Purchasing Power Decline

| Year | Purchasing Power of $1 | What $1 Could Buy |

|---|---|---|

| 1913 | $1.00 | 30 chocolate bars |

| 1950 | $0.13 | 4 chocolate bars |

| 2000 | $0.05 | 1.5 chocolate bars |

| 2025 | $0.03 | Less than 1 bar |

Critical Thinking

1. Since the Federal Reserve was created in 1913 to "stabilize the dollar," the dollar has lost approximately % of its value.

2. How does inflation violate the biblical principle of "honest weights and measures" (Deuteronomy 25:15)?

Multiple Choice

1. Since 1913, the dollar has lost approximately:

○ A) 10%

○ B) 50%

○ C) 75%

○ D) 96-97%

2. Inflation is best described as:

○ A) Natural economic growth

○ B) A hidden tax through money printing

○ C) Increased production costs

○ D) Supply chain issues

3. In 1913, $1 could buy 30 chocolate bars. Today it buys:

○ A) 30 chocolate bars

○ B) 15 chocolate bars

○ C) 5 chocolate bars

○ D) Less than 1 chocolate bar

True or False

1. Inflation is a natural economic phenomenon outside human control.

○ True ○ False — Correction:

2. The Fed was created to "stabilize" the dollar.

○ True ○ False — Correction:

3. Your savings lose value every year due to inflation.

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. Write: How much value has the dollar lost? What could $1 buy in 1913 vs today?

TEACH-BACK CHALLENGE

Explain to someone how inflation steals purchasing power.

Person: Date:

Question:

Answer:

SCRIPTURE MEMORY: Deuteronomy 25:15

"But thou shalt have a perfect and just weight, a perfect and just measure shalt thou have..."

Write:

APPLICATION STEP

What I did:

Result:

Lesson 5: Who Owns the Federal Reserve?

The Federal Reserve is privately owned by its member banks. It is not "federal" and it has no "reserves."

The Secret Meeting at Jekyll Island

In November 1910, six powerful men met in secret at Jekyll Island, Georgia, to draft the Federal Reserve Act. They traveled under assumed names to avoid detection.

- Nelson Aldrich (Senator, Rockefeller associate)

- Paul Warburg (Partner at Kuhn, Loeb & Co.)

- Frank Vanderlip (President of National City Bank)

- Henry Davison (J.P. Morgan partner)

- Woodrow Wilson [President who signed the Federal Reserve Act, 1919]

Fill in the Blanks

1. The secret meeting to create the Federal Reserve took place at Island in 1910.

2. The Federal Reserve is owned by its banks, such as JPMorgan Chase and Citigroup.

Multiple Choice

1. The secret meeting to plan the Federal Reserve took place at:

○ A) The White House

○ B) Jekyll Island, Georgia

○ C) Wall Street, New York

○ D) London, England

2. Which president signed the Federal Reserve Act and later regretted it?

○ A) Abraham Lincoln

○ B) Theodore Roosevelt

○ C) Woodrow Wilson

○ D) Franklin Roosevelt

3. Paul Warburg was a partner at:

○ A) Goldman Sachs

○ B) Kuhn, Loeb & Co.

○ C) Bank of America

○ D) Citigroup

True or False

1. The Jekyll Island meeting was public and well-documented at the time.

○ True ○ False — Correction:

2. The bankers traveled under assumed names to avoid detection.

○ True ○ False — Correction:

3. The Federal Reserve is "federal" and has "reserves."

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. Write: Where did the meeting happen? Name 3 attendees. What did Woodrow Wilson say?

TEACH-BACK CHALLENGE

Tell someone about the Jekyll Island conspiracy.

Person: Date:

Question:

Answer:

SCRIPTURE MEMORY: Ephesians 5:11

"And have no fellowship with the unfruitful works of darkness, but rather reprove them."

Write:

APPLICATION STEP

What I did:

Result:

Lesson 6: The 2008 Bailout (Theft from Taxpayers)

In 2008, the "Too Big to Fail" banks caused a global financial crisis through risky gambling with derivatives. Instead of failing, they were bailed out by the taxpayers.

Top Banks & Bailouts

| Bank | Total Assets (approx.) | Bailout Received (TARP) |

|---|---|---|

| Citigroup | $1.7 Trillion | $45 Billion |

| Bank of America | $2.6 Trillion | $45 Billion |

| AIG (Insurance) | - | $68 Billion |

| General Motors | - | $50 Billion |

Reflection

1. Who paid for these bailouts?

2. Did the bank executives stop receiving bonuses after the bailout? (Research this if you don't know)

Multiple Choice

1. How much did Citigroup receive in TARP bailout funds?

○ A) $1 billion

○ B) $10 billion

○ C) $45 billion

○ D) $100 billion

2. What phrase was used to justify the bailouts?

○ A) "Too small to matter"

○ B) "Too big to fail"

○ C) "Too fast to stop"

○ D) "Too complex to understand"

3. AIG (an insurance company) received approximately:

○ A) $10 billion

○ B) $45 billion

○ C) $68 billion

○ D) $100 billion

True or False

1. The taxpayers paid for the bank bailouts.

○ True ○ False — Correction:

2. Bank executives gave up their bonuses after receiving taxpayer money.

○ True ○ False — Correction:

3. The banks that caused the crisis were allowed to fail.

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. Write: What was TARP? How much did the top 3 recipients get? Who paid?

TEACH-BACK CHALLENGE

Explain the 2008 bailout injustice to someone.

Person: Date:

Question:

Answer:

SCRIPTURE MEMORY: Proverbs 28:8

"He that by usury and unjust gain increaseth his substance, he shall gather it for him that will pity the poor."

Write:

APPLICATION STEP

What I did:

Result:

Lesson 7: Biblical Perspective on Money & Usury

The Bible has strict laws regarding money, debt, and interest (usury). The modern banking system violates almost all of them.

Scripture Lookup

Look up the following verses and write what they say about money, debt, and usury:

Exodus 22:25 - "If you lend money to any of My people who are poor among you..."

Proverbs 22:7 - "The rich rules over the poor, and..."

Leviticus 25:35-37 - Commands regarding lending to brothers

Deuteronomy 25:15 - "You shall have a perfect and just weight, a perfect and just measure..."

Biblical Definition of Usury

Hebrew: neshek (נֶשֶׁךְ) - Strong's H5392 = "bite"

Definition: Usury in the Bible refers to charging any interest on a loan, especially to a brother or the poor. The Hebrew word literally means "to bite"—interest "bites" away at the borrower's resources.

Historical Context: For 1,500 years (from early church through Middle Ages), the Christian church condemned charging ANY interest on loans as a mortal sin. This changed during the Reformation era as commerce expanded.

Torah Command: Exodus 22:25, Leviticus 25:35-37, Deuteronomy 23:19-20 - Do NOT charge interest to brothers/poor

Discussion

5. How does the debt-based money system enslave people according to Proverbs 22:7 ("The borrower is servant to the lender")?

Multiple Choice

1. The Hebrew word for "usury" (neshek) literally means:

○ A) Profit

○ B) Bite

○ C) Growth

○ D) Blessing

2. For how many years did the Christian church condemn ALL interest as sin?

○ A) 100 years

○ B) 500 years

○ C) 1,500 years

○ D) Never

3. According to Proverbs 22:7, the borrower is:

○ A) Blessed

○ B) Wise

○ C) Servant to the lender

○ D) Free

True or False

1. The Torah permits charging interest to the poor.

○ True ○ False — Correction:

2. Deuteronomy 25:15 commands honest weights and measures.

○ True ○ False — Correction:

3. The Bible has little to say about money and debt.

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. Write: What does "neshek" mean? What do Exodus 22:25, Leviticus 25:35-37, and Proverbs 22:7 say?

TEACH-BACK CHALLENGE

Explain the biblical view of usury and debt to someone.

Person: Date:

Question:

Answer:

SCRIPTURE MEMORY: Exodus 22:25

"If thou lend money to any of my people that is poor by thee, thou shalt not be to him as an usurer, neither shalt thou lay upon him usury."

Write:

APPLICATION STEP

What I did:

Result:

Lesson 8: Solutions & What You Can Do

While the system is powerful, you are not helpless. You can take steps to protect yourself and your family.

Action Steps

- Get Out of Debt: "The borrower is servant to the lender" (Proverbs 22:7). Stop paying interest to the banks. Pay off credit cards, car loans, student loans. Become the lender, not the borrower.

- Real Assets: Invest in things that retain value regardless of the dollar's collapse: precious metals (gold, silver), productive land, tools, skills, seeds. Babylon's paper money will burn; physical assets endure.

- Support Audit/End the Fed: Contact your representatives. Demand transparency. Support politicians who vote to audit or end the Federal Reserve.

- Education: Share this knowledge with your family, church, community. Most people have absolutely no idea how money is created or who controls it. Be a messenger of truth.

- Build Community: Develop local trade networks, barter systems, and mutual aid. When the system collapses (and Scripture prophesies Babylon WILL fall), those with community will survive.

- Prayer: Pray for the fall of Babylon's corrupt system (Revelation 18:2-4) and the establishment of Yahuah's kingdom where there is no usury, no debt slavery, and no theft by inflation.

- Revelation 18:4

Final Review

1. What is the most important thing you learned from this workbook?

2. What is one change you will make in your financial life based on this information?

Multiple Choice

1. According to Proverbs 22:7, the first step to financial freedom is:

○ A) Invest in stocks

○ B) Get out of debt

○ C) Open more credit cards

○ D) Trust the government

2. Real assets that retain value include:

○ A) Paper money

○ B) Credit cards

○ C) Gold, silver, land

○ D) Bank accounts

3. Revelation 18:4 commands believers to:

○ A) Join Babylon's system

○ B) Come out of Babylon

○ C) Invest in big banks

○ D) Trust the Federal Reserve

True or False

1. There is nothing individuals can do about the banking system.

○ True ○ False — Correction:

2. Building local community networks provides protection when systems fail.

○ True ○ False — Correction:

3. Scripture prophesies Babylon will stand forever.

○ True ○ False — Correction:

RECALL EXERCISE

Close this workbook. List the 6 action steps from this lesson. Which will you implement first?

TEACH-BACK CHALLENGE

Share what you learned with your family/community.

Person: Date:

Their reaction:

Action they committed to:

SCRIPTURE MEMORY: Revelation 18:4

"And I heard another voice from heaven, saying, Come out of her, my people, that ye be not partakers of her sins, and that ye receive not of her plagues."

Write:

FINAL APPLICATION - COMMITMENT

Based on this workbook, I commit to:

My primary commitment:

Target completion date:

Accountability partner:

SPACED REVIEW TRACKER

Review each lesson at these intervals:

| Lesson | Done | D1 | D3 | D7 | D21 | D60 |

|---|---|---|---|---|---|---|

| 1. What is the Federal Reserve | ||||||

| 2. Before the Federal Reserve | ||||||

| 3. How They Did It | ||||||

| 4. How Money is Created | ||||||

| 5. Debt Slavery System | ||||||

| 6. Biblical View of Money | ||||||

| 7. What Can Be Done | ||||||

| 8. Personal Application |

ANSWER KEY

Lesson 1: What is the Federal Reserve?

Fill-in/Short: 1. December 23 | 2. False - private banking cartel | 3. Passed while Congress was away

Multiple Choice: 1-B (private banking cartel), 2-C (12), 3-C (never)

True/False: 1-False (private, not government), 2-True, 3-False (bills repeatedly blocked)

Lesson 2: Fractional Reserve Banking

Short: 1. 10% reserves, 90% lent, money multiplier | 2. $50,000

Multiple Choice: 1-C (90%), 2-C ($10,000), 3-C (Debt/Nothing)

True/False: 1-False (banks create money), 2-True, 3-False (10% reserves)

Lesson 3: The National Debt Scam

Analysis: 1. ~390,000% increase | 2. Taxes or more borrowing

Multiple Choice: 1-C ($38 trillion), 2-D ($113,000), 3-B (interest never created)

True/False: 1-True, 2-False (interest NOT created), 3-True

Lesson 4: Currency Devaluation

Short: 1. 96-97% | 2. Inflation = dishonest measure

Multiple Choice: 1-D (96-97%), 2-B (hidden tax), 3-D (less than 1)

True/False: 1-False (caused by money printing), 2-True (but failed), 3-True

Lesson 5: Who Owns the Federal Reserve?

Fill-in: 1. Jekyll | 2. Member (private)

Multiple Choice: 1-B (Jekyll Island), 2-C (Woodrow Wilson), 3-B (Kuhn, Loeb)

True/False: 1-False (secret meeting), 2-True, 3-False (neither federal nor reserves)

Lesson 6: The 2008 Bailout

Short: 1. Taxpayers | 2. No, bonuses continued

Multiple Choice: 1-C ($45 billion), 2-B (too big to fail), 3-C ($68 billion)

True/False: 1-True, 2-False (bonuses continued), 3-False (bailed out)

Lesson 7: Biblical Perspective

Scripture: Ex 22:25 (no usury to poor) | Prov 22:7 (borrower=servant) | Lev 25:35-37 (no interest to brothers) | Deut 25:15 (honest weights)

Multiple Choice: 1-B (bite), 2-C (1,500 years), 3-C (servant to lender)

True/False: 1-False (forbidden), 2-True, 3-False (much teaching on money)

Lesson 8: Solutions

Multiple Choice: 1-B (get out of debt), 2-C (gold, silver, land), 3-B (come out)

True/False: 1-False (many things you can do), 2-True, 3-False (Babylon will fall)

Personal answers will vary - Look for genuine understanding and practical commitments