Welcome, Wise Steward!

Money is a tool that Yahuah has given us to manage. This workbook will teach you how to handle money according to Scripture - how to earn honestly, save wisely, give generously, and avoid the traps that lead to financial bondage. True wealth comes from following Yahuah's principles!

Table of Contents

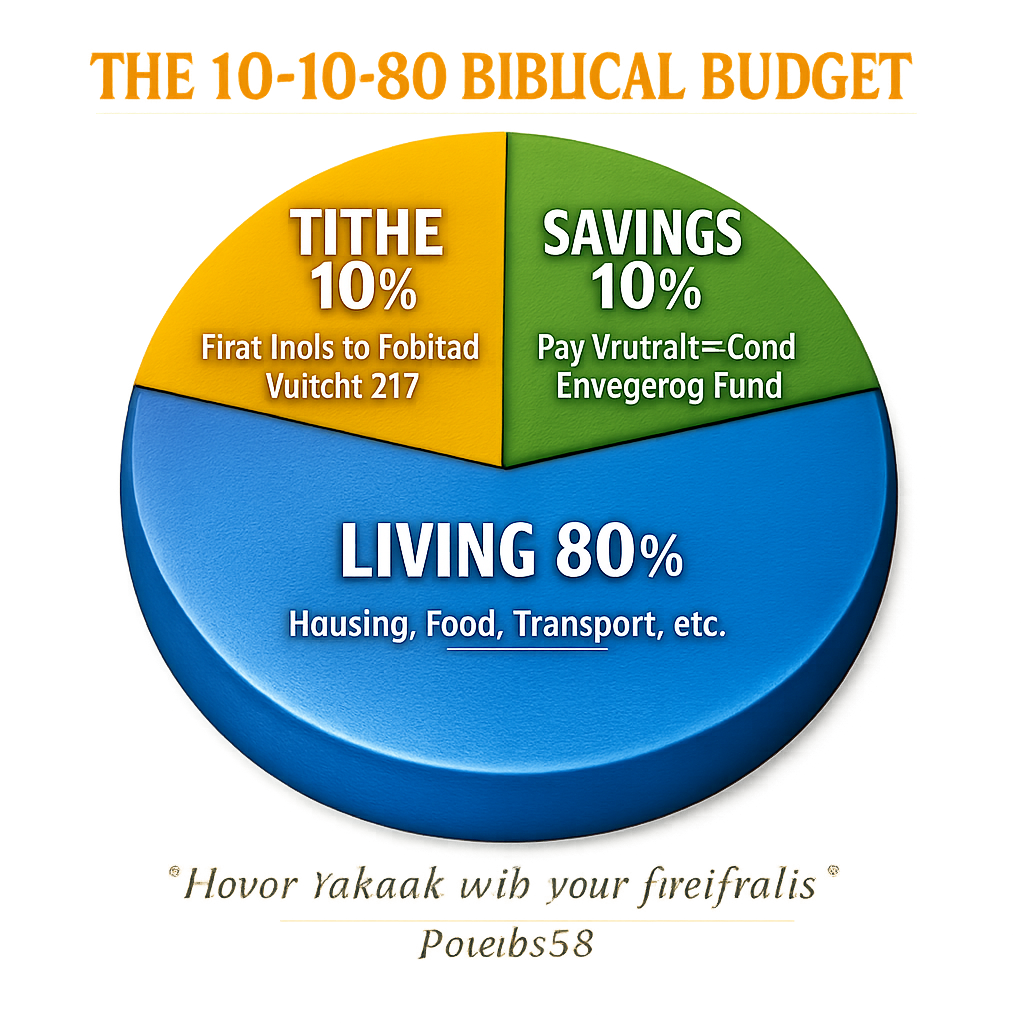

The 10-10-80 Biblical Budget Principle

Lesson 1: Yahuah Owns Everything

RECEIVE

The foundation of biblical finance starts with one truth: Yahuah owns everything. Every dollar, every possession, every resource ultimately belongs to Him. We are not owners - we are managers of what belongs to our Creator.

Key Principle: Divine Ownership

When we understand that everything belongs to Yahuah, it changes how we think about money. We're not asking "What do I want to do with MY money?" but "What does Yahuah want me to do with HIS resources?"

What Yahuah Owns:

- The Earth: "For every beast of the forest is mine, and the cattle upon a thousand hills" (Psalm 50:10)

- All Silver and Gold: "The silver is mine, and the gold is mine, saith Yahuah of hosts" (Haggai 2:8)

- Our Very Lives: "In him we live, and move, and have our being" (Acts 17:28)

- Our Abilities: "But thou shalt remember Yahuah thy Elohim: for it is he that giveth thee power to get wealth" (Deuteronomy 8:18)

REFLECT

Think about your possessions - your clothes, devices, money. How does knowing that these all belong to Yahuah change how you should use them?

RECALL

Fill in the blanks:

- According to Psalm 24:1, the belongs to Yahuah.

- We are not of money, but stewards or .

- Haggai 2:8 says the and belong to Yahuah.

- Deuteronomy 8:18 reminds us that Yahuah gives us power to get .

RECITE

Write this verse from memory:

REVIEW

Answer these questions:

- Why is it important to understand that Yahuah owns everything?

- How should this truth affect how we spend money?

RESPOND

Write a prayer acknowledging that everything you have belongs to Yahuah and asking for wisdom to manage His resources well:

Lesson 2: We Are Stewards

RECEIVE

A steward is someone who manages another person's property. In biblical times, wealthy landowners would hire stewards to manage their estates. The steward didn't own anything - but was responsible for everything!

The Parable of the Talents (Matthew 25:14-30)

Yahusha told a story about a master who gave his servants different amounts of money (talents) to manage while he was away:

- Servant 1: Received 5 talents, invested wisely, earned 5 more = REWARDED

- Servant 2: Received 2 talents, invested wisely, earned 2 more = REWARDED

- Servant 3: Received 1 talent, buried it out of fear, earned nothing = PUNISHED

Lesson: We must wisely use what Yahuah gives us, not waste or hide it!

What Makes a Good Steward?

- Faithful: Trustworthy with small and large amounts

- Wise: Makes good decisions with resources

- Accountable: Knows they will answer to the Owner

- Productive: Works to increase, not waste resources

REFLECT

If Yahuah asked you today how you've managed the money He's given you, what would you say? Are you being a faithful steward?

RECALL

Fill in the blanks:

- A steward is someone who another person's property.

- 1 Corinthians 4:2 says stewards must be found .

- In the Parable of the Talents, the servants who invested wisely were .

- The servant who buried his talent was because he wasted his opportunity.

RECITE

Write this verse from memory:

REVIEW

Answer these questions:

- What's the difference between an owner and a steward?

- Why did the master punish the servant who buried his talent?

RESPOND

List three ways you can be a more faithful steward of the resources Yahuah has given you:

Lesson 3: Honest Work

RECEIVE

The biblical way to obtain money is through honest work. From the beginning, Yahuah designed humans to work: "And Yahuah Elohim took the man, and put him into the garden of Eden to dress it and to keep it" (Genesis 2:15).

Biblical Principles of Work

- Work is good: It was given BEFORE the fall, not as punishment

- Work should be honest: "Provide things honest in the sight of all men" (Romans 12:17)

- Work should be diligent: "Whatsoever thy hand findeth to do, do it with thy might" (Ecclesiastes 9:10)

- Work has rewards: "The labourer is worthy of his reward" (1 Timothy 5:18)

Dishonest Ways to Get Money (Avoid These!)

- Stealing or taking what isn't yours

- Cheating or deceiving others in business

- Gambling (trusting chance instead of Yahuah)

- Exploiting others for profit

- Getting something for nothing (laziness)

REFLECT

What kind of work might Yahuah be preparing you to do? How can you develop skills and a work ethic now that will help you later?

RECALL

Fill in the blanks:

- The soul of the (lazy person) has nothing, but the will prosper.

- Work was given to Adam the fall, showing it is a blessing, not a curse.

- Ecclesiastes 9:10 tells us to do our work with all our .

- The is worthy of his reward.

RECITE

Write this verse from memory:

REVIEW

Answer these questions:

- Why is gambling considered wrong according to Scripture?

- What does "honest work" mean practically?

RESPOND

What chores or jobs do you currently have? How can you do them more diligently as service to Yahuah?

Lesson 4: The Tithe Principle

RECEIVE

The word tithe means "tenth." Throughout Scripture, Yahuah's people gave the first 10% of their income back to Him. This practice acknowledges that He is the source of all we have.

Out of every 10 parts, 1 goes to Yahuah first, then we manage the other 9.

Why Give the First 10%?

- Acknowledges Yahuah as source: It reminds us everything comes from Him

- Protects against greed: Giving first prevents us from holding too tightly

- Tests our trust: Do we trust Yahuah with our finances?

- Supports Yahuah's work: Helps teach others and care for the needy

Tithing Examples

- If you earn $50 mowing lawns, the tithe is $5

- If you receive $100 for your birthday, the tithe is $10

- If you earn $1,000 from a summer job, the tithe is $100

REFLECT

Is it hard to give the first 10% before spending on yourself? Why do you think Yahuah asks for the "firstfruits" rather than what's left over?

RECALL

Fill in the blanks:

- The word "tithe" means .

- Proverbs 3:9 says to honor Yahuah with our .

- The tithe should be given , not after we spend on ourselves.

- 10% of $80 equals $.

RECITE

Write the key phrase from memory:

REVIEW

Practice Calculating Tithes:

1. Birthday money: $75 → Tithe = $

2. Weekly allowance: $20 → Tithe = $

3. Summer job earnings: $450 → Tithe = $

4. Selling old items: $35 → Tithe = $

RESPOND

How can you start practicing the tithe principle with any money you receive?

Lesson 5: Saving & Planning

RECEIVE

Ants teach us an important lesson: save during times of plenty for times of need. Biblical wisdom encourages us to plan ahead and not spend everything we have.

The 10-10-80 Principle

A simple biblical framework for managing money:

- First 10%: Give to Yahuah (tithe)

- Second 10%: Save for the future

- Remaining 80%: Live on the rest wisely

Example: $100 Income

| Category | Percentage | Amount |

|---|---|---|

| Tithe (Give First) | 10% | $10 |

| Savings | 10% | $10 |

| Living/Spending | 80% | $80 |

Why Save?

- Emergencies: Unexpected expenses will come

- Opportunities: Good investments require capital

- Goals: Major purchases require planning

- Wisdom: "A good man leaveth an inheritance to his children's children" (Proverbs 13:22)

REFLECT

Do you currently save any of the money you receive? What goals might you save toward?

RECALL

Fill in the blanks:

- Proverbs 6 tells us to consider the and learn wisdom.

- The 10-10-80 principle: First 10% to , second 10% to , and 80% to on.

- A good man leaves an to his children's children.

- Saving prepares us for and opportunities.

RECITE

Write this verse from memory:

REVIEW

Practice the 10-10-80 Principle:

If you receive $50:

→ Tithe: $

→ Savings: $

→ Spending: $

RESPOND

Set a savings goal for yourself. What do you want to save for, and how much will you need?

Lesson 6: Avoiding Debt

RECEIVE

Debt is one of the greatest financial traps in modern society. Scripture warns that when you borrow money, you become a servant to the lender. This means you lose freedom - your time and earnings now belong to someone else until you pay them back.

The Danger of Debt

- Interest: You pay back MORE than you borrowed

- Stress: Debt creates worry and anxiety

- Bondage: Your future income is already spent

- Limits giving: Hard to be generous when in debt

- Broken relationships: "Neither a borrower nor a lender be"

The True Cost of Debt: Credit Card Example

You buy a $500 item on a credit card at 18% interest, paying $25/month:

- Time to pay off: 24 months (2 years!)

- Total interest paid: $99

- Total cost: $599 (you paid $99 extra!)

Better choice: Save $25/month for 20 months, then buy with cash!

How to Stay Debt-Free

- Save first, buy later: If you can't afford it now, save for it

- Distinguish needs from wants: Do you really need it?

- Use cash: Helps you spend only what you have

- Emergency fund: Savings prevent borrowing in crisis

- Be content: Don't buy things to impress others

REFLECT

Why do you think so many people go into debt? What cultural pressures encourage borrowing?

RECALL

Fill in the blanks:

- Proverbs 22:7 says the borrower is to the lender.

- When you pay , you pay back more than you borrowed.

- Instead of borrowing, we should first, then buy.

- An fund prevents borrowing in a crisis.

RECITE

Write this verse from memory:

REVIEW

Answer these questions:

- What does it mean that "the borrower is servant to the lender"?

- Give an example of when saving and waiting is better than borrowing:

RESPOND

Make a commitment to avoid unnecessary debt. What strategies will you use?

Lesson 7: Contentment vs. Covetousness

RECEIVE

Contentment means being satisfied with what Yahuah has provided. Covetousness means always wanting more, especially what belongs to others. The Tenth Commandment says "Thou shalt not covet" - it's that important!

Signs of Covetousness

- Always comparing what you have to others

- Never satisfied, always wanting the "next thing"

- Jealousy when others have nice things

- Spending money you don't have to keep up appearances

- Thinking money will make you happy

The Secret of Contentment

Paul wrote: "I have learned, in whatsoever state I am, therewith to be content. I know both how to be abased, and I know how to abound... I can do all things through Messiah which strengtheneth me" (Philippians 4:11-13).

Contentment is learned - it doesn't come naturally. It comes from trusting that Yahuah provides what we truly need.

Truths That Bring Contentment:

- Yahuah knows what you need better than you do

- Material things never truly satisfy

- Rich people aren't automatically happy

- Gratitude changes perspective

- Your worth isn't measured by possessions

REFLECT

Think of a time you really wanted something, got it, and then soon wanted something else. What does this teach you about contentment?

RECALL

Fill in the blanks:

- Godliness with is great gain.

- We brought into this world and can carry nothing out.

- The Tenth Commandment says "Thou shalt not ."

- Paul said contentment is , not automatic.

RECITE

Write this verse from memory:

REVIEW

Answer these questions:

- What's the difference between contentment and laziness?

- Why does covetousness lead to financial problems?

RESPOND

List 10 things you're thankful for that money can't buy:

Lesson 8: Generosity & Giving

RECEIVE

Beyond the tithe, Yahuah calls us to be generous - giving freely to those in need. Generosity reflects the heart of Yahuah, who "so loved the world that He gave His only begotten Son."

Types of Giving in Scripture

- Tithe: The first 10% given to Yahuah's work

- Offerings: Freewill gifts beyond the tithe

- Alms: Giving to the poor and needy

- Hospitality: Sharing food and shelter with others

The Widow's Mites (Mark 12:41-44)

Yahusha watched people giving at the temple. Rich people gave large amounts, but a poor widow gave just two small coins. Yahusha said she gave MORE than all the others because she gave all she had - it was sacrificial.

Lesson: Yahuah measures giving by sacrifice, not amount.

How to Give:

- Cheerfully: "Elohim loveth a cheerful giver" (2 Corinthians 9:7)

- Secretly: "Let not thy left hand know what thy right hand doeth" (Matthew 6:3)

- Sacrificially: Give until it costs you something

- Regularly: Make giving a habit, not an afterthought

REFLECT

When have you experienced the joy of giving? How did it feel to help someone in need?

RECALL

Fill in the blanks:

- Luke 6:38 promises that when we give, it will be unto us.

- Elohim loves a giver.

- The widow's gift was greater because she gave .

- Giving to the poor is called giving .

RECITE

Write this verse from memory:

REVIEW

Answer these questions:

- Why did Yahusha say the widow gave more than the rich people?

- What does it mean that "Elohim loves a cheerful giver"?

RESPOND

Plan a way you can practice generosity this week:

Lesson 9: Creating a Budget

RECEIVE

A budget is a plan for how you'll use your money. It helps you "count the cost" and make sure your spending aligns with your values and goals. Without a budget, money tends to disappear without purpose.

Steps to Create a Simple Budget

- Track income: Know exactly what money is coming in

- Tithe first: Give the first 10% to Yahuah

- Save second: Put away at least 10% for future

- List expenses: Know where money is going

- Prioritize needs: Necessities before wants

- Review regularly: Adjust as needed

Sample Youth Budget: $60/month income

| Category | Amount | % |

|---|---|---|

| Tithe | $6.00 | 10% |

| Savings | $6.00 | 10% |

| Long-term goals | $12.00 | 20% |

| Giving/Gifts | $6.00 | 10% |

| Spending money | $30.00 | 50% |

| TOTAL | $60.00 | 100% |

REFLECT

Do you currently know where your money goes? Why is it important to have a plan?

RECALL

Fill in the blanks:

- A budget is a for how you'll use money.

- Luke 14:28 teaches us to sit down and count the first.

- In a budget, should come before wants.

- You should your budget regularly and adjust as needed.

RECITE

Memorize this proverb:

Write this verse from memory (apply it to money - know your finances!):

REVIEW

Create Your Own Budget:

Monthly income (allowance, jobs, gifts): $

| Category | Amount ($) | Percentage (%) |

|---|---|---|

| Tithe | ||

| Savings | ||

| Long-term Goal: | ||

| Giving/Gifts | ||

| Spending |

RESPOND

Commit to tracking your spending for one month. How will you do this?

Lesson 10: Building a Financial Future

RECEIVE

Biblical financial wisdom isn't just about today - it's about building a legacy for future generations. The decisions you make now will affect your family for years to come.

Building Blocks for Financial Success

- Develop valuable skills: Increase your ability to earn

- Live below your means: Spend less than you make

- Avoid debt: Stay free from financial bondage

- Save consistently: Small amounts add up over time

- Give generously: Yahuah blesses the generous

- Invest wisely: Make your money work for you

The Power of Compound Growth

If you save $50/month starting at age 15 with 7% annual growth:

- By age 25: $8,580

- By age 35: $25,220

- By age 45: $58,830

- By age 65: $236,420

Starting early makes an enormous difference!

Financial Traps to Avoid

- Get-rich-quick schemes: "Wealth gotten by vanity shall be diminished" (Proverbs 13:11)

- Cosigning loans: "Be not thou one of them that strike hands" (Proverbs 22:26)

- Credit card debt: The borrower is servant to the lender

- Lifestyle inflation: Spending more just because you earn more

- Following the crowd: Most people are in financial trouble

REFLECT

What kind of financial legacy do you want to leave? What habits do you need to build now?

RECALL

Fill in the blanks:

- A good man leaves an inheritance to his .

- To build wealth, spend than you earn.

- Compound growth means your earns more money over time.

- Proverbs warns against get--quick schemes.

RECITE

Write this verse from memory:

REVIEW

Summarize the key financial principles you've learned in this course:

- About ownership:

- About stewardship:

- About work:

- About tithing:

- About saving:

- About debt:

- About contentment:

- About giving:

RESPOND

Write your personal financial commitment - what principles will you live by?

Answer Key

Lesson 1: Yahuah Owns Everything

- earth

- owners, managers

- silver, gold

- wealth

Lesson 2: We Are Stewards

- manages

- faithful

- rewarded

- punished

Lesson 3: Honest Work

- sluggard, diligent

- before

- might

- labourer

Lesson 4: The Tithe Principle

- tenth (or one-tenth)

- firstfruits (or substance)

- first

- $8

Practice calculations: $7.50, $2, $45, $3.50

Lesson 5: Saving & Planning

- ant

- Yahuah (or tithe), savings, live

- inheritance

- emergencies

10-10-80 practice: $5, $5, $40

Lesson 6: Avoiding Debt

- servant

- interest

- save

- emergency

Lesson 7: Contentment vs. Covetousness

- contentment

- nothing

- covet

- learned

Lesson 8: Generosity & Giving

- given

- cheerful

- sacrificially (or all she had)

- alms

Lesson 9: Creating a Budget

- plan

- cost

- needs

- review

Lesson 10: Building a Financial Future

- children's children (or grandchildren)

- less

- money (or savings)

- rich